Sept.17,2016:

Better Margin for Sugar Companies hence Higher valuation for Sugar Shares: As prices in the International Mkt. is firming up & also increasing as follows:-

Sept.5,2016: Indications are that the Bright future for Sugar Industry started. In Season starting from 1st Oct.2016 to 31st

Oct.17 Sugar Industry would be in earning Mode.

June 14,2016: Stock of Renuka Sugar gained Rs4/- today.

24th May2016:-In the Range Bound Market of Today: Sugar Shares are One of the Best: Three Shares are recommended. Shree Renuka, Shakti Sugars and Dalmia Bharat

21st May 2016:-

1.The Govt. of India has withdrawan Export Subsidy on Sugar:

Domestic Production down by4.43%

17Months high in International Future Market in Chicago.

Sugar Cycle Moves in Two years On-Off Cycles.Currently On Cycle.

Expected Increase in End User Realization Prices.

Sugar prices have witnessed an uptrend in global markets supported by

Recently, the Rabobank raised its sugar deficit estimate to 6.8 million tonnes from 4.7 million tonnes, while FO Licht hiked its estimate to 7.2 million tonnes from 6.5 million tonnes. The deeper deficit is largely due to poor Asian crop led by unfavourable weather conditions, especially a reduction seen in output from India, Thailand and China. ISMA expects the country's overall production to stand at around 25.5-26 million tonnes for 2015-16 against 28.3 million tonnes produced last season.

Better Margin for Sugar Companies hence Higher valuation for Sugar Shares: As prices in the International Mkt. is firming up & also increasing as follows:-

- Season2015-16: Sugar Production declined by 11% to 25.2 Million Tonnes.

- In Season2016-17: Expected decline by 8% to 23.2Million tonnes

Sept.5,2016: Indications are that the Bright future for Sugar Industry started. In Season starting from 1st Oct.2016 to 31st

Oct.17 Sugar Industry would be in earning Mode.

June 14,2016: Stock of Renuka Sugar gained Rs4/- today.

24th May2016:-In the Range Bound Market of Today: Sugar Shares are One of the Best: Three Shares are recommended. Shree Renuka, Shakti Sugars and Dalmia Bharat

21st May 2016:-

1.The Govt. of India has withdrawan Export Subsidy on Sugar:

2.The business restructuring carried out at

debt-laden Sakthi

SugarsBSE

-1.24 % has been

successful and the company, which failed in two successive CDRs, has a better

future now. Tamil Nadu

based Sakthi Sugars owed Rs 1,100 crore to five banks. Even at the numbers

below the current sugar prices restructuring leave the company in a situation

where the Debt Servicing Capability is good and assured with a certain amount

of buffer as well, Arcil, the country's oldest asset reconstruction company

(ARC), bought 50 per cent of Rs 1,100 crore loan taken from five banks led by Bank of India and its internal teams started working on the

restructuring from 2014. As part of a three-pronged solution, Arcil wrote off a

part of the bad debt, converted Rs 61 crore of its debt for a 19 per cent

equity and also refinanced one of the group companies which was given a loan by

Sakthi Sugars, he said. One of the group companies, was given a loan by the

parent, now been refinanced for a period of four years, thereby helping the

cash flows of Sakthi Sugars. Failed the CDR twice, in 2009 and 2013, and Arcil

has time till 2022 to be with the company Fees, coupon on the loan and equity

upside."

Restoring value in a business.

Volatile sugar industry, subject to government-set minimum support price, caps on exports and other restrictions, Banks holding the security receipts will be able to redeem above par, also be able to sell their security receipts (SRs) in the secondary market . The company had reported Rs 20.05 crore loss on a revenue of Rs 147.33 crore for the quarter ended December.Sakthi Sugars stocks closed 2.6 per cent down at Rs 37 on the BSE , as against a 1.19 per cent correction in the benchmark Sensex.

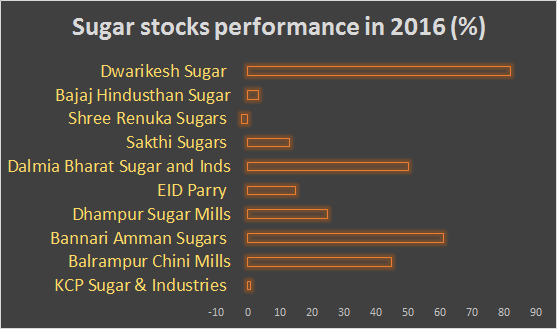

During 2016 Stocks of Sugar Producers soared 82%. Declining Global Production and rising Global Prices.Restoring value in a business.

Volatile sugar industry, subject to government-set minimum support price, caps on exports and other restrictions, Banks holding the security receipts will be able to redeem above par, also be able to sell their security receipts (SRs) in the secondary market . The company had reported Rs 20.05 crore loss on a revenue of Rs 147.33 crore for the quarter ended December.Sakthi Sugars stocks closed 2.6 per cent down at Rs 37 on the BSE , as against a 1.19 per cent correction in the benchmark Sensex.

Domestic Production down by4.43%

17Months high in International Future Market in Chicago.

Sugar Cycle Moves in Two years On-Off Cycles.Currently On Cycle.

Expected Increase in End User Realization Prices.

Sugar prices have witnessed an uptrend in global markets supported by

prospects for a

deeper global deficit in 2015-16 than initially

forecast, thus

increasing expectations for tight supplies.

Moreover,

strength in the Brazilian real coupled with weakness in the US dollar index have also acted as a

positive for the dollar-denominated sugar prices.

Taking cues from the firmness seen in overseas markets along with improved export demand and lower production forecast for this season, sugar has

Taking cues from the firmness seen in overseas markets along with improved export demand and lower production forecast for this season, sugar has

seen a decent

rally on the NCDEX an appreciation in the rupee

capped further

gains in the sweetener on the domestic bourses.

Recently, the Rabobank raised its sugar deficit estimate to 6.8 million tonnes from 4.7 million tonnes, while FO Licht hiked its estimate to 7.2 million tonnes from 6.5 million tonnes. The deeper deficit is largely due to poor Asian crop led by unfavourable weather conditions, especially a reduction seen in output from India, Thailand and China. ISMA expects the country's overall production to stand at around 25.5-26 million tonnes for 2015-16 against 28.3 million tonnes produced last season.

Indian mills have

scaled back expectations of sugar output due to

drought, notably

in Maharashtra, a major growing region, and Karnataka, the third biggest

producer. The association also updated that Indian millers have

contracted around 1.4 million tonnes of sugar to export this current

season against Minimum Indicative Export Quota (MIEQ), out of which about 1

million tonne has already been exported.

From a short-term

perspective, NCDEX SUGAR MAY contract has a key

resistance at Rs

3,440, which, if crossed, can be seen approaching Rs 3,470- Rs 3,500-

Rs 3,530 levels, whereas supports can be seen at Rs 3,420- Rs 3,400-

Rs 3,380- Rs 3,350 levels.

https://tophtc.com/how-to-change-username-in-shopee-4-easy-steps/

ReplyDelete