CMP is Rs.28+-. Hence Upward Movements started. Right time to Purchase this Share.

Stock Market,Different Means of Banking & Finance-Domestic as well as International; Purification of Thoughts;Ways to deal with Income Tax Ways to deal with Service Tax

Thursday, July 14, 2016

Indian Equity:Upside Movements in BSE NSE FUTURE CONSUMER-Multibaggar Stock: Updated on 4th Mar.17: Biggest Food Processing Company

CMP is Rs.28+-. Hence Upward Movements started. Right time to Purchase this Share.

Tuesday, July 12, 2016

Indian Equity: NSE ANANT RAJ- Powerful Company & Hidden Gem in Real Estate in National Capital Region:

e

On 20th July Anant Raj have touched Upper Circuit.

On 20th July Anant Raj have touched Upper Circuit.

- Demerger of real estate division of Anant Raj Agencies Private Limited into Tauras Promoters & Developers Private Limited and subsequent amalgamation of remaining ARAPL with the company," the NCR-based real estate company in its filing.

- Anant Raj shares are

locked at 20 percent upper circuit intraday Wednesday, hitting fresh 52-week high of Rs 56.45 after the board of directors

decided to demerge real estate and project divisions.

- Demerger

of project division of the company into Anant Raj Global. AND made it wholly owned subsidiary Anant Raj Global in due course to be listed on BSE &

NSE.

- Anant Raj's

shareholders will get one share of Anant Raj Global for every one share held

- The rationale behind the demerger of real estate division of Anant Raj Agencies Private Limited into Tauras Promoters & Developers Private Limited is elimination of layer of promoter investment company and streamlining promoting holding structure of Anant Raj.

- After the implementation of scheme of arrangement, promoters and non-promoters' shareholding in Anant Raj will remain at 63.44 percent and 36.56 percent, respectively. Anant Raj Global will have same shareholding pattern (promoters - 63.44 percent and non-promoters - 36.56 percent) against 100 percent stake by promoters earlier.

- Anant Raj's profit in the year ended March 2016 fell significantly to Rs 64.2 crore from Rs 142.38 crore in FY15 and revenue also declined to Rs 433.07 crore from Rs 484 crore in same period.

- Anant Raj Agencies had revenue of Rs 2.43 crore in FY16.

- Anant Raj Global is under incorporation. Project division,

which reported turnover of Rs 138.33 crore in FY16 (contributing 31.94 percent

to total turnover of listed entity Anant Raj), has executed or in process of

executing several projects realted to construction of IT parks, residential

projects, township projects, SEZ, malls and commercial projects.

- As of March 2015, the company had equity worth Rs 4,133 crore and debt of Rs 984 crore.

- "This company has assets that could be at least worth Rs 10,000 crore while the debt is Rs 1,000 crore.

- Stil, its market cap stands at about Rs 1,500 crore.

- The stock price has rallied over 50 percent in the past three months

from a low of Rs 34. Still it offers plenty of upside potential for

the long-term investor.

Monday, July 11, 2016

Indian Equity Market: Updated 22nd March:Make Federal Bank a part of Portfolio Currently Quoted @Rs.84/- to Rs.89/-approx.

The Share has started picking up on the Bourses. Start Accumulation Would definitely give a better Return in 2018.

Remain Invested in Federal Bank on Long term Sustainable Basis.

Stock is a part of Strong BANK NIFTY of 12 Stocks.

Working of the Bank is very Disciplined.

In the past ICICI Bank has made bids to acquire this Bank

3rd Quarter Results Substantial Increase in Revenue

Reduction in NPAs:-

_______________________________________________

Earlier Present

Gross: 2.78 2.77

Net 1.69 1.58

_______________________________________________

Net Interest Margin: 30%

Loan & Adv Growth: 32%

Thursday, April 28, 2016

Indian Equity:7th Oct.16, Consolidation in Cement Industry: After NIRMA purchased Lafarge Shares: C.K.Birla group Orient Cement Buys Two Jaypee Cement Units for Rs.2000Crores

Large Indian Cement players are looking for Multistate Manufacturing & Marketing:

_________________________________________________________________________________

If Lafarge-Nirma and Century Ultratech deals takes place it would increase consolidation of Cement Manufacturing Capacities in Less number of Hands. Would it increase valuation of Cement Shares?

SWOT Analysis:-

Strengths:- Expected Demand in:-

In immediate future no threat is visible

_________________________________________________________________________________

If Lafarge-Nirma and Century Ultratech deals takes place it would increase consolidation of Cement Manufacturing Capacities in Less number of Hands. Would it increase valuation of Cement Shares?

SWOT Analysis:-

Strengths:- Expected Demand in:-

- Infrastructure Development

- Development of Corridor near Railway Lines

- Big Gap of Housing Projects.

- Development of Sm art Cities.

- Consolidation:- The Cement is a Capital Intensive Industry, for setting it up needs high Investment. The Investment includes Huge Amount of Bank Loans. The Companies not able to meet Bank Repayment dead lines are selling their Plants. Lafarge-Birla AND Jaypee-Ultratech deals in recent past are few examples.

- Already increase in prices in Western India.

- Creation of Additional Manufacturing Capacities is very slow.

- Expected Heavy Rainfall which would give momentum to Civil Construction

Weaknesses:-

- Capital Intensive requiring very high Capital Investment.

In immediate future no threat is visible

- PAN India:-Ultratech &ACC

- Northern India: J.K.Laxmi-Manglam

- Southern India: Ambuja & Dalmia Bharat

Sunday, March 20, 2016

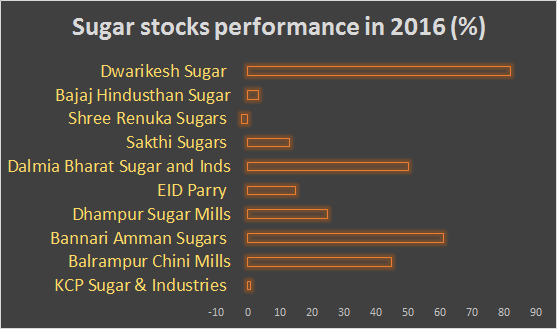

Indian Equity: Updated on 17th Sep.16:1. Hold Stock of Sugar companies:

Sept.17,2016:

Better Margin for Sugar Companies hence Higher valuation for Sugar Shares: As prices in the International Mkt. is firming up & also increasing as follows:-

Sept.5,2016: Indications are that the Bright future for Sugar Industry started. In Season starting from 1st Oct.2016 to 31st

Oct.17 Sugar Industry would be in earning Mode.

June 14,2016: Stock of Renuka Sugar gained Rs4/- today.

24th May2016:-In the Range Bound Market of Today: Sugar Shares are One of the Best: Three Shares are recommended. Shree Renuka, Shakti Sugars and Dalmia Bharat

21st May 2016:-

1.The Govt. of India has withdrawan Export Subsidy on Sugar:

Domestic Production down by4.43%

17Months high in International Future Market in Chicago.

Sugar Cycle Moves in Two years On-Off Cycles.Currently On Cycle.

Expected Increase in End User Realization Prices.

Sugar prices have witnessed an uptrend in global markets supported by

Recently, the Rabobank raised its sugar deficit estimate to 6.8 million tonnes from 4.7 million tonnes, while FO Licht hiked its estimate to 7.2 million tonnes from 6.5 million tonnes. The deeper deficit is largely due to poor Asian crop led by unfavourable weather conditions, especially a reduction seen in output from India, Thailand and China. ISMA expects the country's overall production to stand at around 25.5-26 million tonnes for 2015-16 against 28.3 million tonnes produced last season.

Better Margin for Sugar Companies hence Higher valuation for Sugar Shares: As prices in the International Mkt. is firming up & also increasing as follows:-

- Season2015-16: Sugar Production declined by 11% to 25.2 Million Tonnes.

- In Season2016-17: Expected decline by 8% to 23.2Million tonnes

Sept.5,2016: Indications are that the Bright future for Sugar Industry started. In Season starting from 1st Oct.2016 to 31st

Oct.17 Sugar Industry would be in earning Mode.

June 14,2016: Stock of Renuka Sugar gained Rs4/- today.

24th May2016:-In the Range Bound Market of Today: Sugar Shares are One of the Best: Three Shares are recommended. Shree Renuka, Shakti Sugars and Dalmia Bharat

21st May 2016:-

1.The Govt. of India has withdrawan Export Subsidy on Sugar:

2.The business restructuring carried out at

debt-laden Sakthi

SugarsBSE

-1.24 % has been

successful and the company, which failed in two successive CDRs, has a better

future now. Tamil Nadu

based Sakthi Sugars owed Rs 1,100 crore to five banks. Even at the numbers

below the current sugar prices restructuring leave the company in a situation

where the Debt Servicing Capability is good and assured with a certain amount

of buffer as well, Arcil, the country's oldest asset reconstruction company

(ARC), bought 50 per cent of Rs 1,100 crore loan taken from five banks led by Bank of India and its internal teams started working on the

restructuring from 2014. As part of a three-pronged solution, Arcil wrote off a

part of the bad debt, converted Rs 61 crore of its debt for a 19 per cent

equity and also refinanced one of the group companies which was given a loan by

Sakthi Sugars, he said. One of the group companies, was given a loan by the

parent, now been refinanced for a period of four years, thereby helping the

cash flows of Sakthi Sugars. Failed the CDR twice, in 2009 and 2013, and Arcil

has time till 2022 to be with the company Fees, coupon on the loan and equity

upside."

Restoring value in a business.

Volatile sugar industry, subject to government-set minimum support price, caps on exports and other restrictions, Banks holding the security receipts will be able to redeem above par, also be able to sell their security receipts (SRs) in the secondary market . The company had reported Rs 20.05 crore loss on a revenue of Rs 147.33 crore for the quarter ended December.Sakthi Sugars stocks closed 2.6 per cent down at Rs 37 on the BSE , as against a 1.19 per cent correction in the benchmark Sensex.

During 2016 Stocks of Sugar Producers soared 82%. Declining Global Production and rising Global Prices.Restoring value in a business.

Volatile sugar industry, subject to government-set minimum support price, caps on exports and other restrictions, Banks holding the security receipts will be able to redeem above par, also be able to sell their security receipts (SRs) in the secondary market . The company had reported Rs 20.05 crore loss on a revenue of Rs 147.33 crore for the quarter ended December.Sakthi Sugars stocks closed 2.6 per cent down at Rs 37 on the BSE , as against a 1.19 per cent correction in the benchmark Sensex.

Domestic Production down by4.43%

17Months high in International Future Market in Chicago.

Sugar Cycle Moves in Two years On-Off Cycles.Currently On Cycle.

Expected Increase in End User Realization Prices.

Sugar prices have witnessed an uptrend in global markets supported by

prospects for a

deeper global deficit in 2015-16 than initially

forecast, thus

increasing expectations for tight supplies.

Moreover,

strength in the Brazilian real coupled with weakness in the US dollar index have also acted as a

positive for the dollar-denominated sugar prices.

Taking cues from the firmness seen in overseas markets along with improved export demand and lower production forecast for this season, sugar has

Taking cues from the firmness seen in overseas markets along with improved export demand and lower production forecast for this season, sugar has

seen a decent

rally on the NCDEX an appreciation in the rupee

capped further

gains in the sweetener on the domestic bourses.

Recently, the Rabobank raised its sugar deficit estimate to 6.8 million tonnes from 4.7 million tonnes, while FO Licht hiked its estimate to 7.2 million tonnes from 6.5 million tonnes. The deeper deficit is largely due to poor Asian crop led by unfavourable weather conditions, especially a reduction seen in output from India, Thailand and China. ISMA expects the country's overall production to stand at around 25.5-26 million tonnes for 2015-16 against 28.3 million tonnes produced last season.

Indian mills have

scaled back expectations of sugar output due to

drought, notably

in Maharashtra, a major growing region, and Karnataka, the third biggest

producer. The association also updated that Indian millers have

contracted around 1.4 million tonnes of sugar to export this current

season against Minimum Indicative Export Quota (MIEQ), out of which about 1

million tonne has already been exported.

From a short-term

perspective, NCDEX SUGAR MAY contract has a key

resistance at Rs

3,440, which, if crossed, can be seen approaching Rs 3,470- Rs 3,500-

Rs 3,530 levels, whereas supports can be seen at Rs 3,420- Rs 3,400-

Rs 3,380- Rs 3,350 levels.

Tuesday, February 9, 2016

Indian Equity Market:Metal:Updated on 13th September: Steel Sector Tata Steel:

13th Sept.2016:- Tata Steel:

Q1-2016 Loss Rs.3183/-Crores.

SWOT analysis of Tata Steel Proposed Effective Restructuring of its Foreign Business::-

Total Borrowings:-Rs.75259/- Crores as on 30th June 2016: Rs.71798/-Crores including European Business Rs.22500 /- Crores.

10th July 2016:-

2nd June 2016:- Coal India Ltd.(CIL) has increased its Product prices by 5%. CIL share has picked up on BSE.

24th May 2016:-

Coal India Ltd.:- This Share is now totally bottomed out. At Current Valuation the Share is strongly recommended to Purchase.

24th May 2016:

Buy Tata Steel at around Rs.325/-

Earlier News:-

Tata Steel is still favourite of Bourses at Current of Rs345/- the Share Seems Attractive. Target is Rs.400/-

MIP to provide temporary relief to steel industry:

Other Factors are also Counting:-

There is an inverse correlation between the prices of the US dollar and commodities.

Q1-2016 Loss Rs.3183/-Crores.

SWOT analysis of Tata Steel Proposed Effective Restructuring of its Foreign Business::-

Strengths:- Very

Good Plants in

·

Port Talbot,

·

Netherland,

·

Speciality Steel in Yorkshire,

·

and Pipe Mills in Hartle Pool.

Weaknesses :-

High Cost of running Plants and British Steel pension Fund,

Opportunities:-For Ist Two Plants possibility of 50:50 Joint

Venture Between Tata Steel & Thyssen

Krupp Germany.

Proposed 25% Investment by British Government.

Purchase of Last Two Plants by Mr Sanjeev Gupta Indian

Origin Business Man of UK.

Threats :-

To explore Possibility of Cost Reduction by 100 Million Pound.

Suitable outcome for British Steel Pension Scheme1.30 Lac

Members and deficit Pound 70Crores. Discussion with British Trade unions.Total Borrowings:-Rs.75259/- Crores as on 30th June 2016: Rs.71798/-Crores including European Business Rs.22500 /- Crores.

10th July 2016:-

A.Buy back of Shares by Coal India Ltd is a certainty: The Successful completion of Shares by Seven subsidiaries have resulted in Huge Cash in the Hands of Coal India Ltd. and available for buy back of its own Shares.

2nd June 2016:- Coal India Ltd.(CIL) has increased its Product prices by 5%. CIL share has picked up on BSE.

24th May 2016:-

Coal India Ltd.:- This Share is now totally bottomed out. At Current Valuation the Share is strongly recommended to Purchase.

24th May 2016:

Buy Tata Steel at around Rs.325/-

Earlier News:-

Tata Steel is still favourite of Bourses at Current of Rs345/- the Share Seems Attractive. Target is Rs.400/-

MIP to provide temporary relief to steel industry:

Other Factors are also Counting:-

- Adverse demand-supply equation that the Steel industry is likely to face in the short to medium term, it said.

- Poor Demand Growth:- India's steel consumption growth improved driven by automobile and construction sectors.

There is an inverse correlation between the prices of the US dollar and commodities.

With dollar index

peaking, sectors like metals, mining may outperform Defensives

Moderation in the US dollar is usually

positive for Indian equities and currency.

The fall in the dollar may lead many investors to increase their allocation to cyclical stocks than to defensive stocks.

The fall in the dollar may lead many investors to increase their allocation to cyclical stocks than to defensive stocks.

MIP 'game changer'

for steel;

The government

has decided to impose a minimum import price for steel products,

something that is likely to make import prices of the alloy costlier than

local prices. What does this mean for Indian companies?

The government has decided to impose a minimum

import price for

steel products, something that is likely to

make import prices of

the alloy costlier than local prices. What

does this mean for Indian

companies?

It is a bold move,

a minimum import

price (MIP) for

steel products that is likely to make many imported

steel products

costlier than domestic ones. This comes following months

of complaints

from steel companies that cheap Chinese imports were

undercutting

Indian steel companies and hitting their margins.

Following the

decision, the MIP for hot rolled coil (HRC) steel has been

set at USD 450

per tonne, which would result in a landed price of about

USD 600 per tonne

after customs and safeguard duty. The ruling domestic

price of HRC

steel is about USD 500 per tonne, something that will

likely move up

around or before the government's MIP directive comes

into effect on

March 1.

It is the first

time in 15 years the country has imposed MIP -- and said it would give a

much needed shot in the arm to local steel companies,

which have

suffered from over a year of falling prices.

Wednesday, February 3, 2016

Indian Finance: Updated on 2nd Aug. 2016:SMILE-Soft Loan for MICRO,SMALL & MEDIUM ENTERPRISE: MUDRA Small Bank Loans for Traders, Cottage Industries and Retailers under various Bank Schemes Ranging from Rs.10Lacs to Rs.1Crore

For Expansion,Modernization & Technological upgradation to MSME sector. Manufacturing & Processing companies.

- Repayment period 7 years

- For Soft Loan Interest Rate for 3 yrs.9.35

- Term Loan Interest Rate 9.45 to 9.95 period is Three years only.

- After Three years Normal Rate of Interest.

May I take liberty to

encroach upon your valuable time to help you in a systematic Manner: so

that Bankers understand your Business Plans .

To, ensure Good valuation

for Funding through Regular & Systematic Steps in right direction as

follows:-

- At present Govt. of India has sponsored various Bank Loan Schemes without Collateral. For That a detailed review of Current Operation is required.

- Recognize Business Strengths Concentrate on the same & would definitely get Finance.

- Strong Management Information System created out of Streamlined Processes, supported by Budgeting & Performance Measurement & Monitoring.

- MUDRA:- Loan under this Scheme are without any Collateral.Small entrepreneurs under the Pradhan Mantri Mudra Yojana, developing "personal sector" to become self-sufficient, start businesses and generate new employment avenues..Loans between Rs. 50,000 and Rs. 10 lakh are provided to small entrepreneurs.The Micro Units Development and Refinance Agency Ltd (MUDRA) focuses on the 5.75 crore self-employed who use funds totalling Rs. 11 lakh crore and provide jobs to 12 crore people.The banking sector has been allocated an overall disbursement target of

about Rs. 1.22 lakh crore during 2015-16 for Mudra loans.

D.MUDRA Yojana will be refinance for lending to micro businesses/units.1. Shishu: covering loans upto Rs. 50,000/-

2. Kishor: covering loans above Rs. 50,000/- and upto Rs. 5 lakh3. Tarun: covering loans above Rs. 5 lakh and upto Rs. 10 lakhBusinesses/entrepreneurs/units covered would include:-1. Proprietorship/partnership firms running as small manufacturing units, Shopkeepers, Fruits/Vegetable Sellers, hair cutting saloon, beauty parlours, transporters, truck operators, hawkers, co-operatives or body of individuals, food service units, repair shops, machine operators,small industries, artisans, food processors, self help groups, professionals and service providers etc. in rural and urban areas with financing requirements upto Rs 10 lakh.2. Sector/activity specific schemes, such as schemes for business activities in Land Transport, Community, Social & Personal Services,Food Product and Textile Product sectors. Schemes would similarly be added for other sectors / activities.Schemes:-1. Micro Credit Scheme (MCS)2. Refinance Scheme for Regional Rural Banks (RRBs) / ScheduledCo-operative Banks3. Mahila Uddyami Scheme4. Business Loan for Traders & Shopkeepers5.Missing Middle Credit Scheme6. Equipment Finance for Micro Units

Ashok

Agarwala

7228805981

Saturday, January 16, 2016

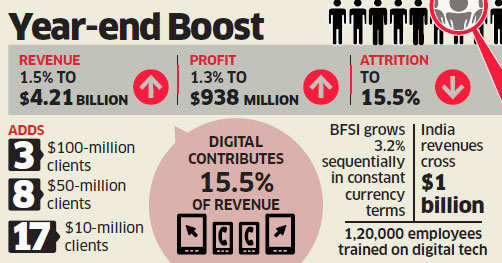

Indian Equity Market: Up dated 16th Sept.16:Lower Revenue for Indian I.T. Cos.: facing Volatile Macro Economic Conditions-World over:

16th Sept.2016:-

Post Brexit: Volatile Macroeconomic Conditions in Europe.

Lower Revenue Expected for IT Comapnies: Main Reasons are:-

Main Dependance are on U.S. and U.K.

Decline in consulting Business.

In India Finacle and other BFSI is showing declining trend.

High Foreign Currency Fluctuations,

Large Deals even though finalized, taking more time than expected to take off/Complete. Immenient uncertainty has compelled Clients World over to delay IT Projects & reduce discretionary spendings.

US Federal Reserve keeping its Interest Rate at Record low

Hence earlier recommendation of 15th July 2016 is not continuing.

15th July2016:

Strong Recommendation for Continuing with TCS &Infosis.

TCS rated world's most powerful brand in IT Services: Report

Scoring highly on a wide

variety of measures such as familiarity,

loyalty, staff satisfaction

and corporate reputation, Tata Consultancy

Services (TCS) emerged as

the IT services industry's most powerful brand

with a score of 78.3 points

earning it an AA+ rating has

been rated as the world's most powerful brand in Information Technology Services

by a leading global brand valuation firm, Brand Finance's 2016 annual report

evaluated thousands of the world's top brands to determine which are the most

powerful and the most valuable. "TCS' customer focus has been central to

its recent success, but a

closer

look at our data shows strong and improving scores for brand

investment

and staff satisfaction too," said David Haigh, CEO, Brand

Finance.

"It has emerged as a dominant force in the IT services industry and is the

strongest brand in the sector. Its brand power is indisputable,"Haigh

said.According to the report, TCS is also the fastest growing brand within its

industry over the last 6 years. The company's overall brand value has increased

from USD 2.34 billion in 2010 (when the first evaluation of the TCS brand was

conducted) to USD 9.4 billion in 2016. The efforts of our 344,000 employees

our

best brand ambassadors have helped our brand strength to be rated at

the

top of our industry," said N Chandrasekaran, CEO and Managing

Director

of TCS.

- Growth from outsourcing becomes harder to generate or the erstwhile levels of growth from outsourcing becomes harder to generate,

- In this volatile Market Choose TCS and HCL Tech are recommended.

* Second-largest software firm Infosys today

Aikido services, bringing the power of intelligent systems,

automation and software to amplify the skills

and imaginations of our people,"

Share Price Rs 1,126.55

Particulars Period F.Y. Rs.Crores Revenue Net Profit

Liquid Assets 31.12.15 31526

30.09.15 32099

Quarter ending 31.12.15 US$240 Crore US$ 52.40 Crores

31.12.15 Rs.15902 Crore Rs.3465 Crores

Quarter Ending 30.09.15 Rs.15635 Crores Rs.3398 Crores

Quarter ending 31.12.14 Rs.13796Crores Rs.3250 Crores

Revenue Quarter Ending 30.09.15 Rs.15635 Crores Rs.3398 Crores

Quarter ending 31.12.14 Rs.13796Crores Rs.3250 Crores

Current fiscal constant Currency Revenue guidance upwards to 12.8-13.2 per cent.

- Revenue rose just 0.5% sequentially,if exchange rate fluctuations were eliminated, and shrank 0.3% otherwise.

- The third-quarter performance makes it unlikely that the nation's top software exporter will beat Nasscom's industry growth guidance of 12-14%for fiscal 2016. TCS

- IT spending to shrink as much as 5.5% in 2015.volatility, uncertainty and an adverse currency.

- TCS' revenue for the quarter rose 0.5% sequentially to $4.14 billion in constant currency terms. On the same basis, and after factoring in the impact of the floods, analysts on average had expected about 0.8% growth. In rupee terms, TCS reported sequential revenue growth of 0.7% to Rs 27,364 crore. Profit after tax was flat at $926 million. In rupee terms, the net profit rose 0.9% sequentially to Rs 6,109 crore. Operating margin contracted 0.48 percentage point to 26.6%.

- Digital, one of the bright spots for the company in the recent past,also slowed.

- Revenue from India, which contributes about 6% to the total,fell 6.7% sequentially. Revenue from international markets grew 1.1% sequentially.North America, which accounts for 53.5% of revenue, grew 1.4% sequentially, but in the UK, a market that contributes about 16%, revenue fell 0.7%.

- Most of the UK contraction has been attributed to the continuing weakness in TCS' insurance platform, Diligenta. "still need a quarter before Diligenta bottoms out. Business demand and order inflow remains intact

- Rival Accenture, which recently reported results for its fiscal first quarter ended November 30, posted double-digital growth in its digitalbusiness.

C.Wipro quarter ended December 31

In-line with Analyst Expectations.

"A pick-up in large deal closures

led by Global Infrastructure Services.

Customers want to simplify operations, optimize their IT spend while investing in Digital to transform their business & are well-positioned ,"

Customers want to simplify operations, optimize their IT spend while investing in Digital to transform their business & are well-positioned ,"

*Net profit: *

Quarter ended

December 31, 2015, December 31, 2014

Rs. 2,234 crore Rs. 2192crore

Increase of around 2% year-on-year.

December 31, 2015, December 31, 2014

Rs. 2,234 crore Rs. 2192crore

Increase of around 2% year-on-year.

*Dividend:*

*Outlook for March Quarter - Guidance:*

IT Services business to be in the range of $ 1,875

million to $1,912 million.

Expectation for Next Financial Year.

Expectation for Next Financial Year.

*IT Services

Segment: *

- IT services segment Profit rose to Rs 2,480 crore ($375 million), while margins stand at 20.2%.

- IT services segment Non-GAAP constant currency revenue in dollar terms grew 1.4% sequentially and grew 6.3% YoY.

- Headcount of 170,664

- Added 39 new customers during the quarter.

*Large deals:*

Signed a Definitive agreement to

acquire Viteos Group, a BPaaS provider for Alternative Investment

Management Industry.

Winning Large Deals globally

Wipro has entered into a multi-year global infrastructure

support engagement with one of the largest medical devices companies

in the world.

Standardization & Simplification:- Wipro will

standardize and simplify the customer's IT infrastructure across multiple

service lines and in over 90 countries.

"Acquisition:-During the

quarter, competitive differentiation BY Acquisition

of Two high-potential companies - Cellent and Viteos,"

"Business Continuity Plans:-Impact of Chennai floods minimized significantly by strong execution of our robust Business Continuity Plans (BCP). The additional expenses incurred in deploying BCP impacted

Subscribe to:

Comments (Atom)